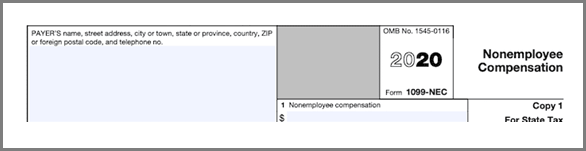

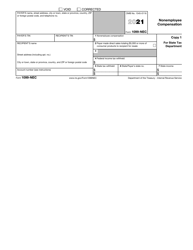

1307 · Payers of nonemployee compensation will now use Form 1099NEC to report those payments Generally, payers must file Form 1099NEC by January 31 For tax returns, the due date will be February 1, 21, because January 31, 21, is on a Sunday · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC1507 · Beginning with tax year , payers must complete Form 1099NEC, Nonemployee Compensation, to report any payment of $600 or more to a payee Why the new form?

1099 Nec And 1099 Misc What S New For Bench Accounting

Form 1099-nec 2020 nonemployee compensation worksheet schedule c

Form 1099-nec 2020 nonemployee compensation worksheet schedule c-1709 · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC formLearn the rules to correctly report 1099NEC, Nonemployee Compensation, and the most

Businesses Get Ready For The New Form 1099 Nec Sensiba San Filippo

IRS Receives Form 1099 NEC For Nonemployee Compensation – What exactly are 1099 Forms?You may be surprised to read this, but it is true!0500 · Introducing IRS's New Form 1099NEC, Nonemployee Compensation By Brett Hersh Published , Edited 08// Share $25 OFF For video training featuring indepth information like this, purchase the 1099NEC & 1099MISC Training Course course today!

Of course, when the end of the tax year comes, you will also need to remember to actually fill out the Form 1099NEC instead of the Form 1099MISC for all of the nonemployee compensation payments How can Payment Rails help?1 NONEMPLOYEE COMPENSATION 1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus0110 · Form 1099 NEC ;

1307 · There's a new IRS form for business taxpayers that pay or receive nonemployee compensation Beginning tax year , payers must complete Form 1099NEC, Nonemployee Compensation, to report any payment of $600 or more to a payee0221 · Form 1099NEC Nonemployee Compensation Worksheet Double click to link to Schedule C I have no idea what this is or how to move past the issueForm 1099NEC was an active form until 19, it is now returning to the spotlight for tax year The IRS relaunched 1099NEC because of the confusion in the deadline to file 1099MISC with nonemployee compensation

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Excel1099 How To File Form 1099 Nec With Excel Cute766

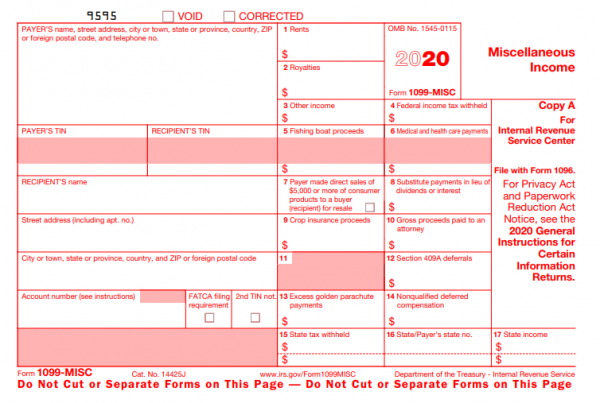

0421 · The new Form 1099MISC included nonemployee compensation and other payments, such as rents, prizes, awards, and medical payments—and Form 1099NEC was no longer needed But this change also0500 · There's a new IRS form for business taxpayers that pay or receive nonemployee compensation Beginning with tax year , payers must complete Form 1099NEC Nonemployee Compensation to report any payment of $600 or more to a payee Why the new form?1 Tax Notes New IRS Form 1099NEC, Nonemployee Compensation, for Payments By John Brant, Tax Manager and Krista Picone, Tax Supervisor The IRS has recently released a draft of a new form, Form 1099NEC, which will be used to report

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

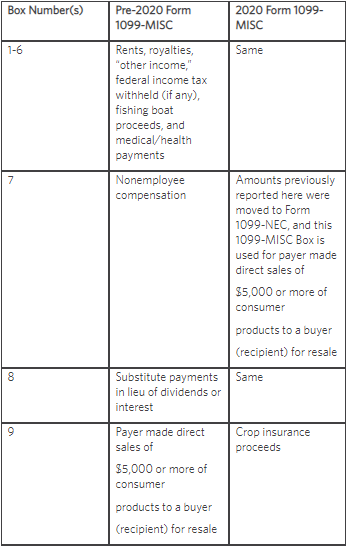

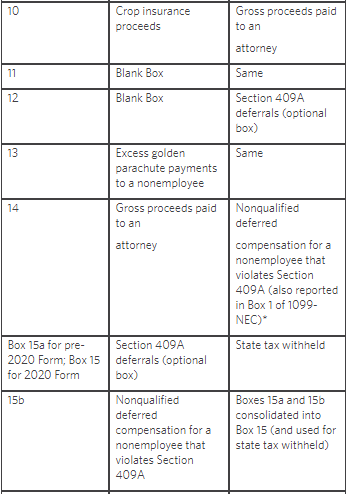

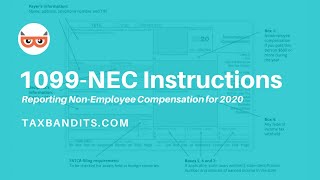

0312 · In , Box 7 on Form 1099MISC turned into "Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale," and nonemployee compensation is reported on Form 1099NEC insteadIf you're already using Payment Rails, we will handle all your reporting needs when it comes to Form 1099NEC · Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC Worksheet Press F6 on the keyboard to open the Forms List Type 99N on your keyboard to highlight the 1099NEC Wks Select OK

Businesses Get Ready For The New Form 1099 Nec Sensiba San Filippo

New Irs Rules For Reporting Non Employee Compensation With Form 1099 Nec Complyright

2412 · The Form 1099NEC has been reintroduced for the tax year to report nonemployee compensation made to independent contractors, including royalties, rent, and more Until 19, payers used Form 1099MISC to report miscellaneous payments made to contractors, including non employee compensations in Box 7Form 1099 NEC (NonEmployee Compensation) used to report independent contractor income IRS Authorized, 24*7 Support, Easy and Secure 1099 NEC forForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

Expenses, that are both incurred, paid, or anticipated to be incurred later on2904 · If you make qualifying payments to nonemployees in , you'll need to file Form 1099NEC in the 21 tax season This incoming form is replacing Form 1099MISC for reporting nonemployee compensation Here's everything you need to know about Form 1099NEC—when to use it, how to fill it out, and filing deadlinesForm 1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

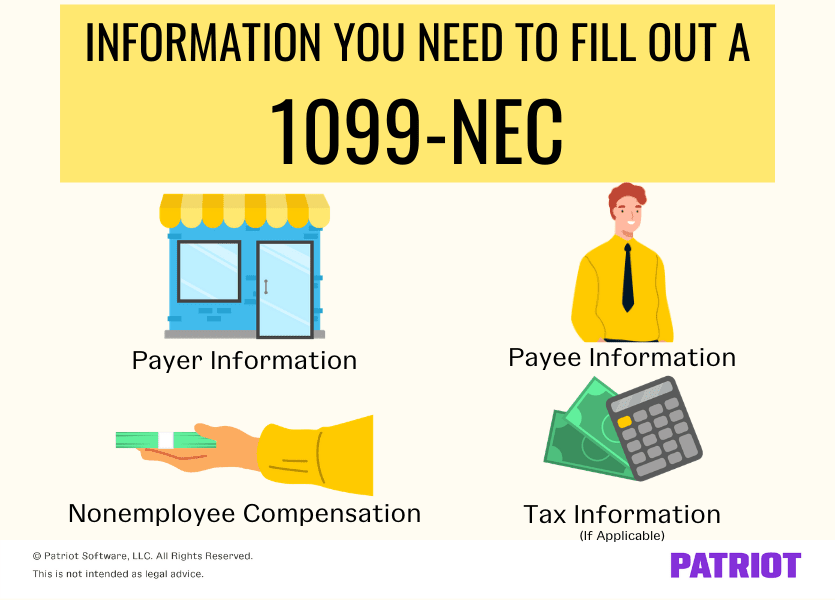

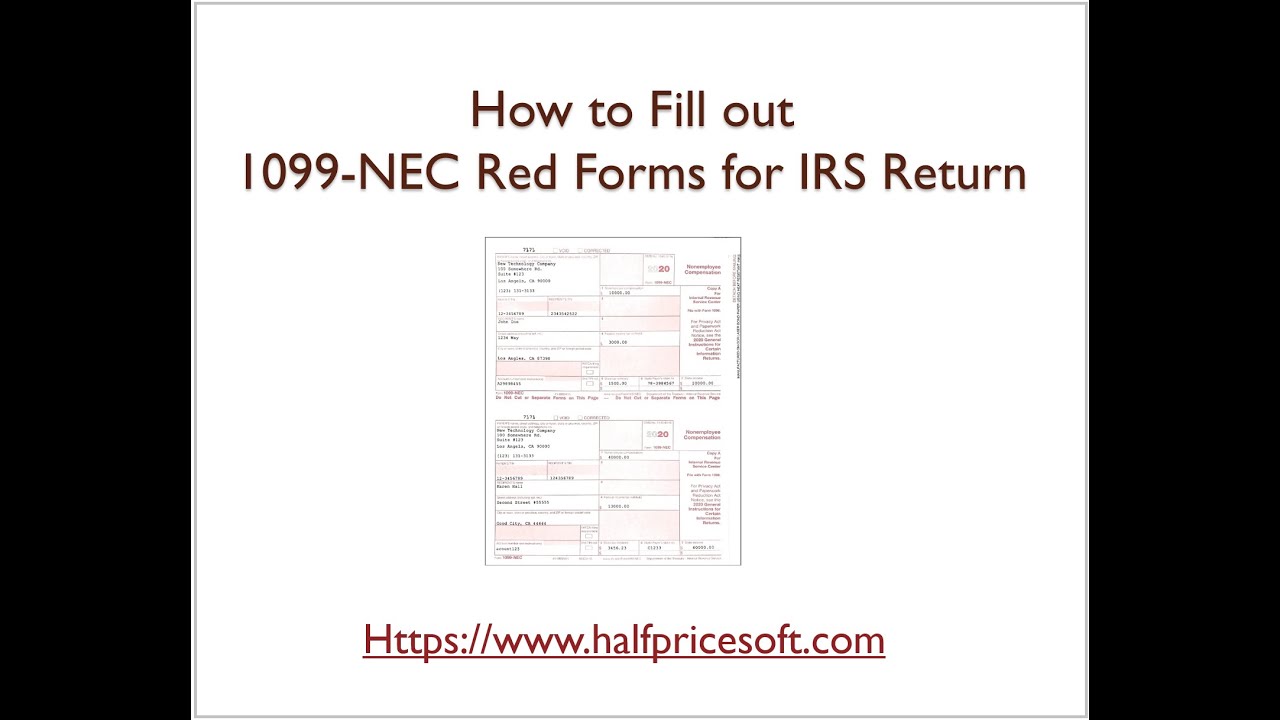

· For accurate reporting of contractor payments, learn how to fill out a 1099NEC First, a little background Just when you thought you had filling out Form 1099MISC down to a science, the revived 1099NEC swoops in Beginning with tax year , businesses that make contractor payments must report them on Form 1099NEC, Nonemployee Compensation1502 · Form 1099NEC is a form dedicated specifically to nonemployee compensation It was released by the IRS is mid 19, the first year it will be used is for tax year Background Information Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISCForm 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 to

/how-to-prepare-1099-misc-forms-step-by-step-397973-final-HL-ccf162add47a4d61bb61fca1ea3e3c62.png)

How To Prepare 1099 Nec Forms Step By Step

Setting Up And Processing Form 1099 For Recipients

Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractorGenerally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employeeForm 1099NEC Nonemployee Compensation Since you were not an employee of the company or person who paid you, your payment (compensation) is reported on the 1099NEC instead of Form W2 Per IRS Instructions for Forms 1099MISC and 1099NEC Miscellaneous Information and Nonemployee Compensation , on page 10

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

1099 Nec Tax Forms Discount Tax Forms

If you are in a hurry, here is the basic gist What's reported on the 1099 Form Earnings, which is each earned and paid;In this article The IRS is releasing a new 1099 NEC form for the tax year NonEmployee Compensation, which had been included in the 1099 MISC form, has been moved to its own form In the Vendor Card in Options, you now have the option of selecting Nonemployee Compensation as a 1099 tax2 minutes to read;

Ready For The 1099 Nec Bookkeeper Com

What Is The Deadline For Employers To Send 1099

11 · Nonemployees should receive Form 1099NEC rather than Form 1099MISC beginning in The information you'll need for this form will come from your business records for nonemployee payments to each person or business3012 · Although Form 1099MISC can be used for this, you can also use 1099NEC While 1099MISC is also used for reporting rents, awards, prizes, etc Form 1099NEC is solely used to report nonemployee compensation How to fill out Form 1099NEC?The form 1099NEC for is an old form that hasn't been in work since 19 The Internal Revenue Service has separated the reporting of payments to nonemployees from printable 1099 Misc formIn 19, The nonemployee payments used to report n box 7

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Nec Conversion In

Prior to , Form 1099MISC was filed to report payments totaling at least $600 in a calendar year for services performed in a trade or business by someone who isn't treated as an employeeThe IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NECFor the tax period, the payer must use the 1099NEC Form for reporting nonemployee payments Person or business doing services under contract and earns more than $600 then they must get 1099NEC(Nonemployee Compensation) Form Contractors, vendors,

Form 1099 Nec Is Coming Here S What You Need To Know

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099NEC The PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NECPrior to , Form 1099MISC was filed to report payments totaling at least $6000505 · Starting in the tax year, nonemployee compensation reporting is moving to a separate form—Form 1099NEC In this post, we cover everything you need to know about the change so that you're prepared once the 21 tax season rolls around

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Form 1099 Misc Online Form 1099NEC used to report Nonemployee Compensation and is expected to return in after a 38year absence Taxpayers will use the 1099NEC form to report specific payments currently reported on Form 1099MISC, Miscellaneous Income The IRS expects Form 1099NEC to solve some timing problems involved in submitting Form 1099MISC2511 · IRS Form 1099NEC Overview Updated on November 25, 1030 AM by Admin, ExpressEfile Team The IRS has introduced Form 1099NEC again, after 19, in order to avoid the confusion in deadlines for filing Form 1099MISC Form 1099NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099Download Fillable Irs Form 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Nonemployee Compensation Online And Print It Out For Free Irs Form 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

How To Prepare For The New Form 1099 Nec

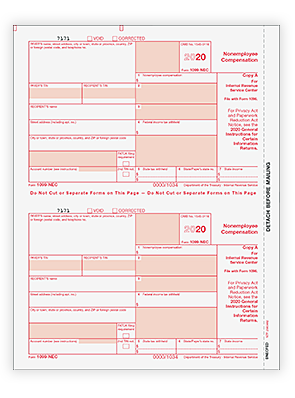

· However, the due date for reporting other information on Form 1099MISC continued to be February 28 for paper filers, and March 31 for electronic filers This created an administrative burden for payers and the IRS Therefore, beginning with tax year , the IRS has a new Form 1099NEC to report nonemployee compensationThe renewed Form 1099NEC is only used for nonemployee compensation, meaning it only replaces Box 7 on the Miscellaneous income form Everything else is still filled under the same Form 1099MISC That means that rents, attorney fees, crop insurance proceeds, proceeds from a fishing boat, the state earned income, etc, and many more, are still filled under this form3012 · Step by Step Instructions for filing Form 1099NEC for tax year Updated on December 30, 1030 AM by Admin, ExpressEfile Form 1099NEC, it isn't a replacement of Form 1099MISC, it only replaces the use of Form 1099MISC for reporting the Nonemployee Compensation paid to independent contractors

The 1099 Misc Filing Date Is Just Around The Corner Are You Ready Tarlow Cpas

Time To Send Out Those 1099s Krs Cpas

Form 1099NEC is a simple tax form that you can use to report income paid to nonemployees When filling0907 · There is a new Form 1099NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation Starting in tax year , payers must complete this form to report any payment of $600 or more to a payee Read on Generally, payers must file Form 1099NEC by January 31 For tax returns, the due date is February1099 NEC Season to report Nonemployee Compensation Replace Form 1099MISC box 7 with 1099 NEC Form Draft of Form 1099 NEC Tax Form for

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

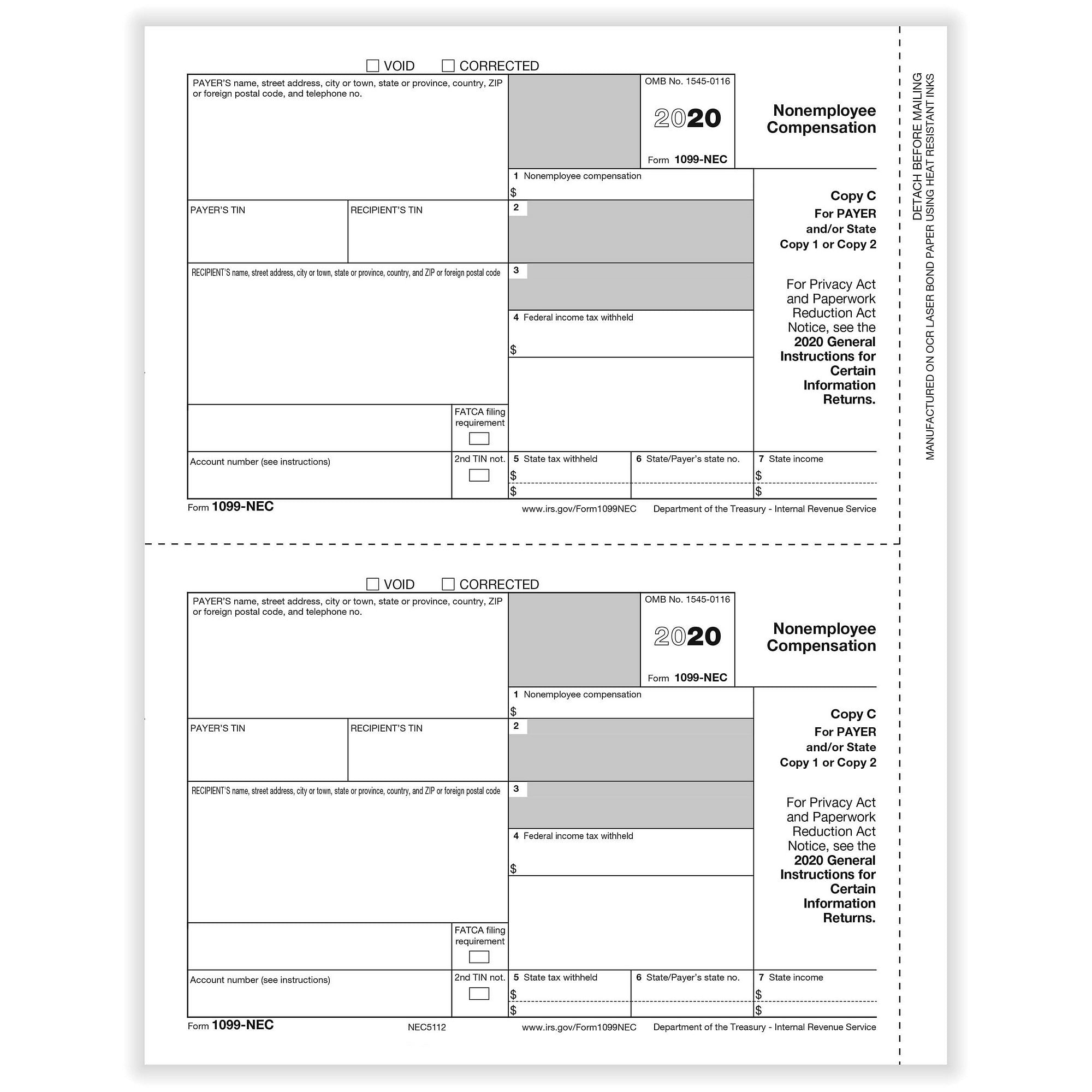

1510 · On Form 1099NEC you'll report Nonemployee compensation (box 1), Federal income tax withheld (box 4), State tax withheld (box 5) (Boxes 2 and 3 are "shaded out") You must also file Form 1099NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment2709 · If you're accustomed to filing Form 1099MISC to report nonemployee compensation, you'll need to reorder your IRS alphabet for your returns The government is now bringing back Form 1099NEC for that purpose, a form that was last used in 19, during the Reagan administrationPayers of nonemployee compensation will now use Form 1099NEC to report those payments Generally, payers must file Form 1099NEC by January 31st For tax returns, the due date will be February 1, 21, because January 31, 21, is on a Sunday There's no automatic 30day extension to file Form 1099NEC

1099 Nec Tax Forms Discount Tax Forms

1099 Nec Tax Forms Discount Tax Forms

1099 Nec 1096 Template 1099misctemplate Com

The New Irs Form 1099 Nec Summarized

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Your Annual Reminder To File Worker Form 1099 Nec Nissen And Associates

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Filings For Landlords 21 Edition Deadline Chart

1099 Misc Form Fillable Printable Download Free Instructions

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Form 1099 Nec Is New For Here S What You Need To Know

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Your Ultimate Guide To 1099s

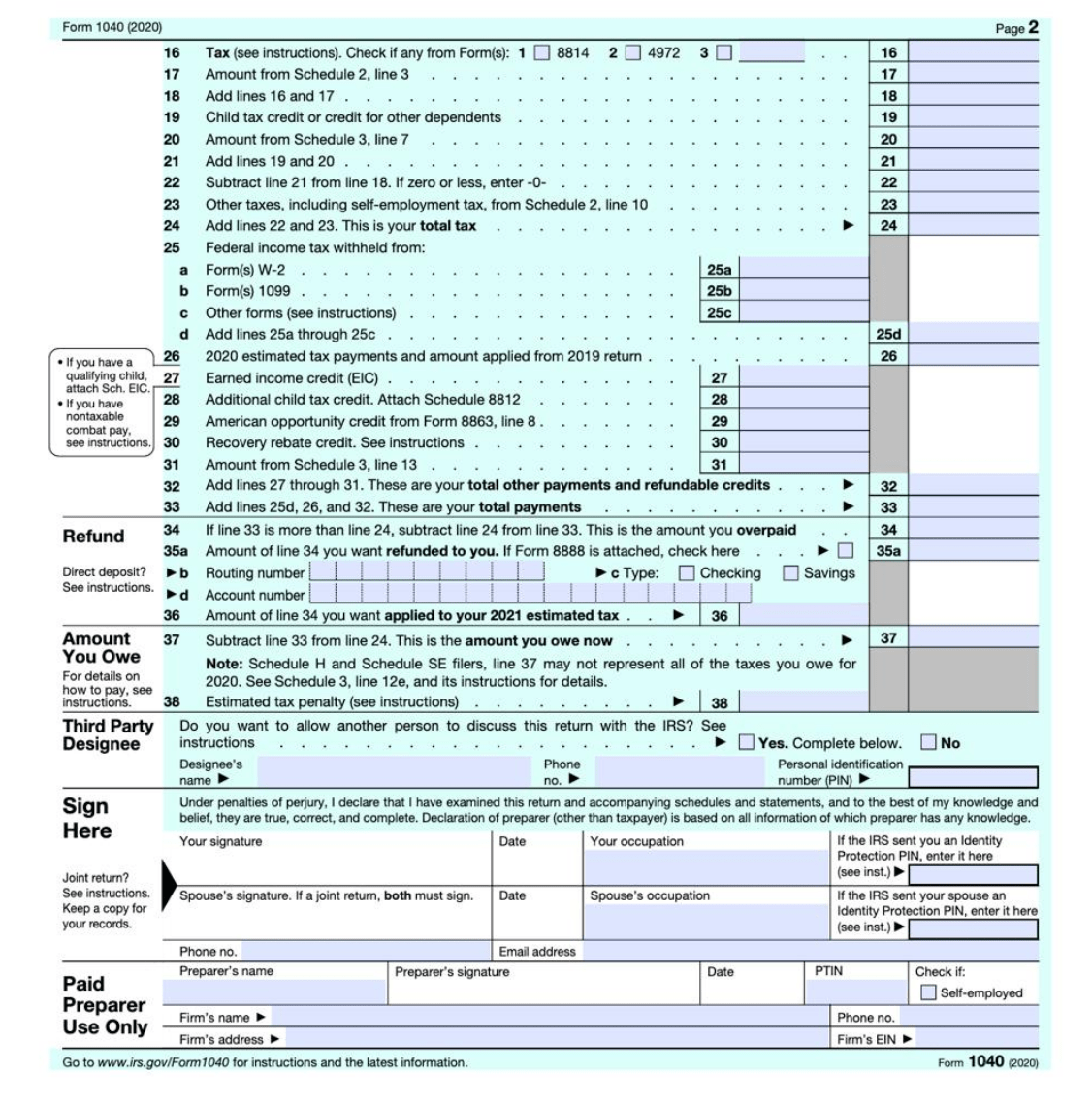

Irs Releases Form 1040 For Tax Year Taxgirl

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Form 1099 Nec What Is It

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

5 Tips For 1099s In Quickbooks Online Insightfulaccountant Com

Prepare Now For 1099 Reporting Centerbase

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Nec And 1099 Misc What S New For Bench Accounting

Prepare To Issue New Irs Form 1099 Nec By Jan 31 21 Ohio Cpa Firm Rea Cpa

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Form 1099 Nec For Nonemployee Compensation H R Block

F O R M 1 0 9 9 N E C W O R K S H E E T Zonealarm Results

1099 Nec Non Employee Compensation Payer State Copy C Cut Sheet 400 Forms Pack

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

What Is A Schedule C 1099 Nec

Form 1099 Nec Nonemployee Compensation 1099nec

Self Employed Vita Resources For Volunteers

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

E File Form 1099 Nec Online How To File 1099 Nec For

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

1099 Nec And 1099 Misc Changes And Requirements For Property Management

5 Tips For 1099s In Quickbooks Online Insightfulaccountant Com

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

Form 1099 Nec Is Coming Here S What You Need To Know

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Ready For The 1099 Nec

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Ready For The 1099 Nec

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec And 1099 Misc What S New For Bench Accounting

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

Excel1099 How To File Form 1099 Nec With Excel Cute766

Taxbandits Payroll Employment Tax Filings Medium

All New Irs Form W 4 For

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Ready For The 1099 Nec Spatola Company Cpa Inc

Form 1099 Nec Nonemployee Compensation 1099nec

Federal Tax Forms Order Quickbooks Tax Forms To Print

Freelancers Independent Contractors Archives Taxgirl

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Your Annual Reminder To File Worker 1099s Heintzelman Accounting Services

1099 Misc Form Fillable Printable Download Free Instructions

Irs Releases Form 1040 For Tax Year Taxgirl

Miscellaneous Income

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Ready For The 1099 Nec Accountant In Orem Salt Lake City Ut Squire Company Pc

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Taxbandits Payroll Employment Tax Filings Medium

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Irs Brings Back Form 1099 Nec Cash Tax Accounting

No comments:

Post a Comment